Guide to Using Single-Member Operating Agreement

Once you have your Single-Member Operating Agreement form ready, it's time to fill it out accurately. This document is essential for outlining the management structure and operational guidelines of your single-member LLC. Follow the steps below to ensure you complete the form correctly.

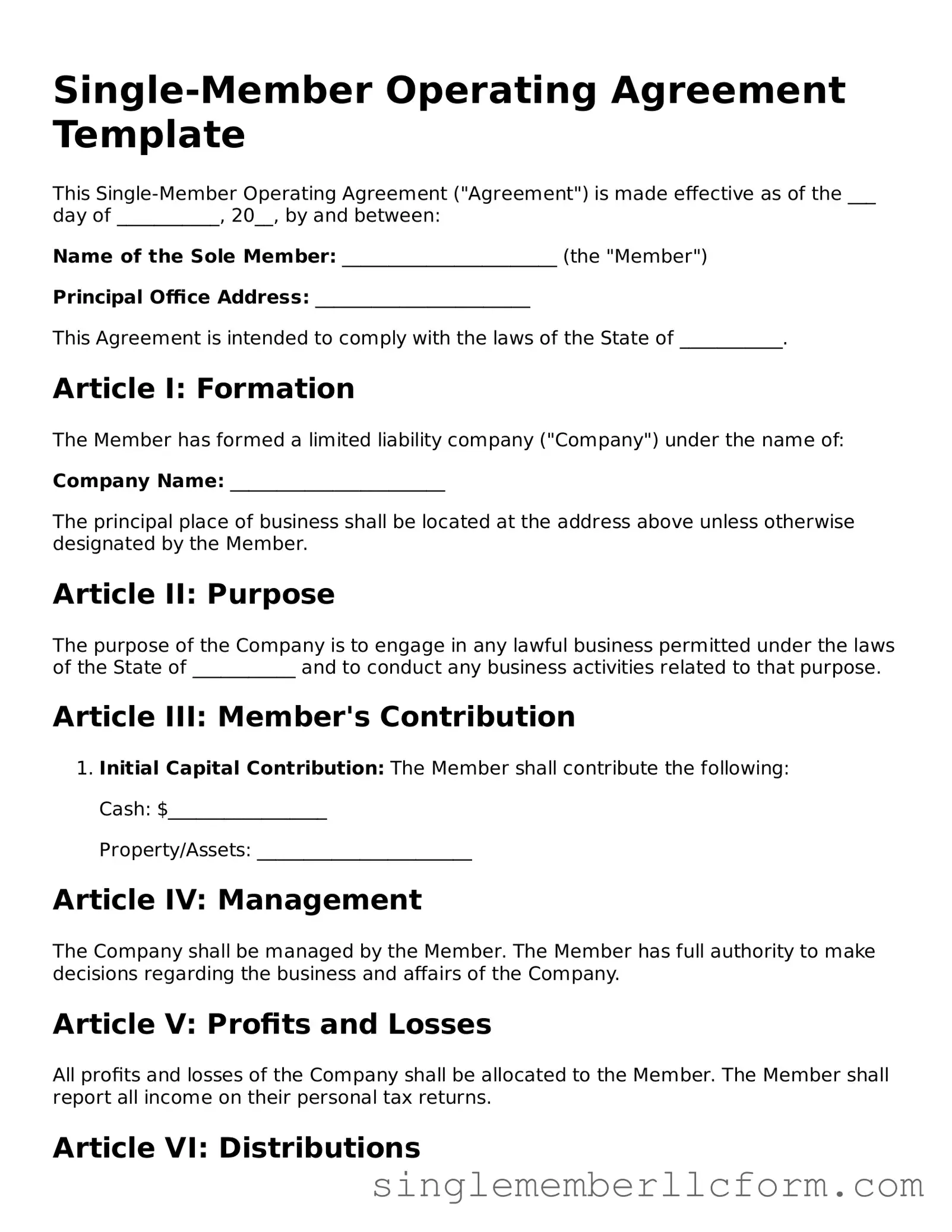

- Title the Document: At the top of the form, write "Single-Member Operating Agreement" to clearly indicate the purpose of the document.

- Identify the LLC: Enter the full legal name of your LLC as registered with your state. This should match the name on your formation documents.

- Provide the Principal Office Address: Fill in the primary business address of your LLC. This is where official correspondence will be sent.

- State the Formation Date: Indicate the date when your LLC was officially formed. This information can typically be found on your formation documents.

- List the Member’s Information: Write your name and address as the sole member of the LLC. Include any contact information you wish to provide.

- Outline Management Structure: Specify how the LLC will be managed. Typically, this will state that you, as the sole member, will manage the LLC.

- Define Capital Contributions: Detail any initial capital contributions you are making to the LLC. This could include cash, property, or services.

- Establish Profit and Loss Distribution: Clearly state how profits and losses will be allocated. Generally, this will be 100% to you as the sole member.

- Include Additional Provisions: If there are any specific rules or procedures you want to include, such as how decisions will be made or how disputes will be resolved, list them here.

- Sign and Date: Finally, sign and date the document. This step is crucial, as it signifies your agreement to the terms outlined in the document.

After completing the form, consider keeping a copy for your records and providing one to any relevant parties. This agreement will serve as an important reference for your LLC's operations moving forward.